In today’s rapidly changing business landscape, companies often face different financial management needs. While some businesses benefit from having a full-time Chief Financial Officer (CFO), others might find fractional CFO services to be a more flexible and cost-effective solution. Let’s explore the differences between these two options to help you decide which is the best fit for your business.

Understanding Fractional CFO Services

Fractional CFO services involve hiring a CFO on a part-time or project basis. This approach provides businesses with access to high-level financial expertise without the full-time commitment.

One of the most appealing aspects of fractional CFO services is their flexibility. Businesses can engage a CFO for specific projects such as strategic planning, financial forecasting, or during transitional periods like mergers and acquisitions. This flexibility allows organizations to pay only for the services they need, making it an ideal choice for startups and growing businesses. Fractional CFO services are especially beneficial for young companies that might not have the resources to afford a full-time CFO.

At Gaines Capital Books, we offer tailored financial services including CFO advisory services to ensure you have the professional support needed to navigate complex financial landscapes. Our fractional services are not just about providing financial expertise but empowering you to focus on growing your business.

What Does a Full-Time CFO Offer?

A full-time CFO is a permanent leader within a company who manages all financial aspects. This role is typically suited to larger businesses requiring ongoing strategic financial management.

Full-time CFOs are deeply integrated into the company’s operations, allowing them to provide constant oversight and leadership. This can be crucial in situations where the company is dealing with high levels of financial complexity or rapid changes in the market. Unlike fractional CFOs, full-time CFOs can offer insights and strategic direction at a moment’s notice.

For companies that operate in fast-paced industries like real estate or technology, having a full-time CFO might be indispensable. These leaders ensure that financial strategies align with business objectives and are agile enough to pivot strategies as necessary. Explore how our expert bookkeeping services are making waves among businesses looking for thorough and diligent oversight.

Cost Considerations

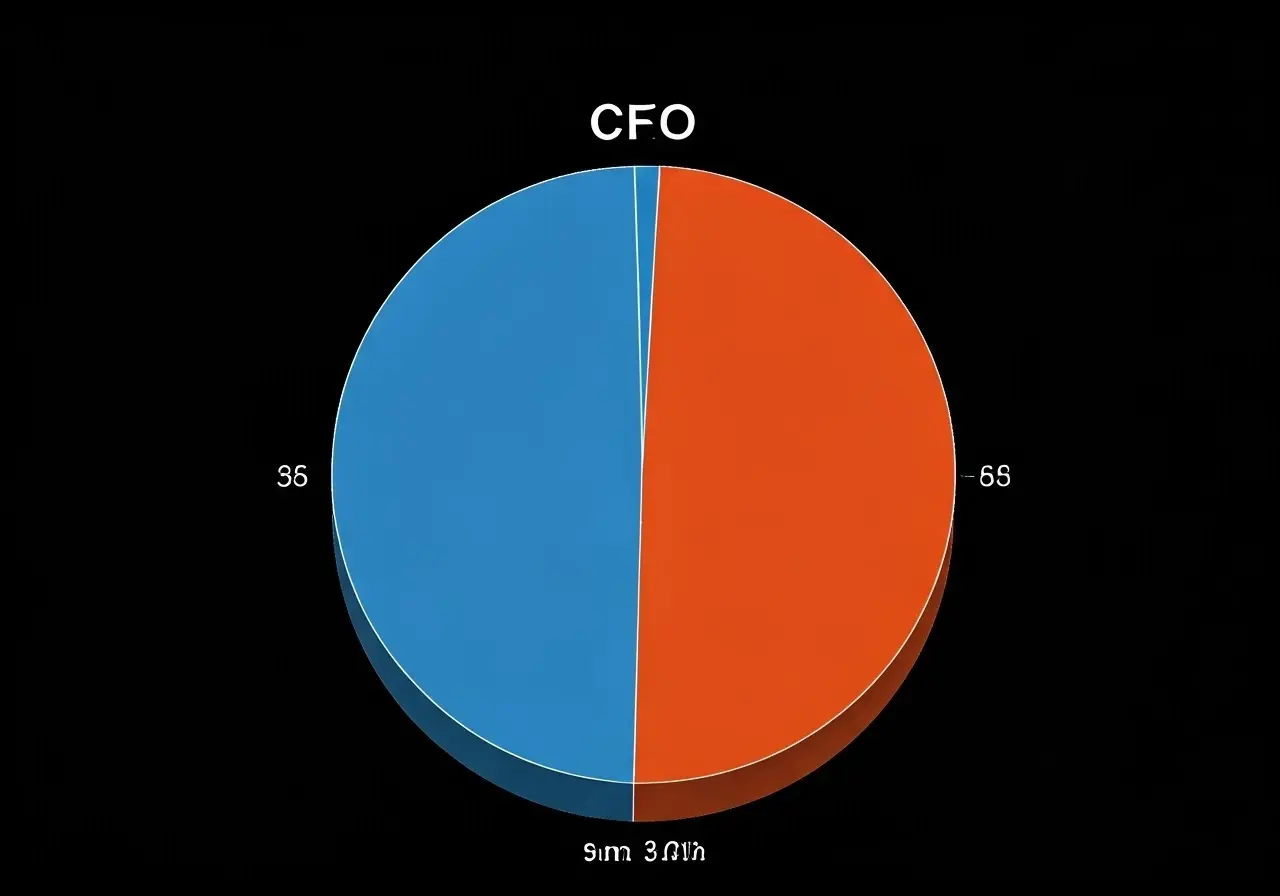

One of the main differences between fractional and full-time CFOs is cost. Fractional CFOs are generally more cost-effective as they are paid based on hours worked or specific projects, whereas full-time CFOs require a full salary and benefits.

The financial commitment involved with hiring a full-time CFO is significant. Companies need to consider not only the salary but also benefits such as healthcare, retirement plans, and bonuses. This can make a full-time CFO less viable for smaller companies or startups that need to manage their budgets carefully.

For venture-backed startups seeking to optimize costs, fractional CFOs can be particularly economical, offering the required financial expertise without a heavy overhead. Cost benefits of hiring a fractional CFO may be critical in early stages when every dollar counts.

Flexibility and Scalability

Fractional CFO services offer greater flexibility, allowing businesses to scale financial expertise as needed. This can be particularly beneficial for growing businesses, startups, or those facing specific financial challenges.

As businesses grow, their financial strategies must evolve. Fractional CFOs can help companies scale seamlessly, adapting financial strategies to fit new business models or market conditions. This ability to scale financial leadership dynamically is a key advantage for businesses in flux.

In contrast, full-time CFOs offer consistency. They can provide ongoing guidance that seamlessly integrates with the business’s long-term goals. It’s essential to choose the option that provides the level of support and scalability your business requires at its present stage. Engage us at Gaines Capital Books for a seamless and strategic growth pathway crafted specifically for real estate investors and e-commerce ventures.

Leadership and Availability

A full-time CFO provides consistent leadership and is always available for urgent financial decisions. On the other hand, a fractional CFO may not be available at all times, which could be a consideration for businesses needing constant financial oversight.

The availability of a full-time CFO can be crucial for businesses operating in fast-paced environments. Having someone who is attuned to the daily workings of the company ensures that strategic and urgent decisions are informed by a deep understanding of the business.

However, for many startups and growing companies, the part-time availability of a fractional CFO is sufficient. These companies often benefit from periodic insights rather than constant oversight, allowing them to balance financial advisory with operational needs effectively.

Evaluating Your Business Needs

When deciding between a fractional or full-time CFO, consider your company’s size, financial complexity, and long-term goals. A thorough evaluation will help you choose the option that aligns best with your current and future needs.

It’s important to assess the financial tasks at hand: Are they project-based or do they require ongoing management? Do you need immediate access to a CFO’s expertise, or is your need more strategic and periodic?

At Gaines Capital Books, we encourage businesses to evaluate whether they need an entire suite of CFO services or if targeted insights would suffice. Our tailored solutions allow you to unlock financial clarity without unnecessary sacrifices, ensuring that your financial leadership is perfectly aligned with your business’s unique landscape and objectives.

Choosing the Right Financial Leadership for Your Business

Choosing between a fractional CFO and a full-time CFO depends on your business’s current needs, financial situation, and future goals. While fractional CFO services offer flexibility and cost-effectiveness, a full-time CFO is ideal for businesses requiring extensive financial leadership. Carefully evaluating your business needs can help you make the most informed decision.