Understanding the CFO services your business needs can be pivotal for its financial health. In today’s business landscape, options like fractional CFO services have emerged alongside traditional full-time CFO roles. But what exactly is the difference between these two choices? In this FAQ, we will explore the key differences, benefits, and considerations for choosing the CFO service that best fits your business needs.

What Are Fractional CFO Services?

Fractional CFO services involve hiring a CFO on a part-time basis, allowing businesses to utilize expert financial management without committing to a full-time executive position. This flexibility is particularly valuable for companies experiencing budget constraints or fluctuating financial needs. By hiring a fractional CFO, businesses can access high-level financial advice tailored specifically to their needs, allowing them to maintain strategic agility during periods of growth or transition.

Moreover, fractional CFOs offer a scalable solution that many businesses find necessary as they grow beyond their initial capabilities but aren’t ready for a full-time CFO. They often work with multiple businesses, bringing a breadth of industry knowledge and experience that can be instrumental for companies needing expertise in varied financial landscapes. Understanding the role of a fractional CFO can help business owners manage resources effectively and gain financial insights vital for strategic decision-making.

What Are Full-Time CFO Services?

A full-time CFO is an executive who works exclusively for your business, managing all financial operations, strategic planning, and leadership tasks on a continuous basis. Unlike fractional CFOs, full-time CFOs are deeply embedded in the corporate culture, allowing them to understand the intricacies of your business and contribute to its long-term vision.

Their presence within the organization means they can address financial issues promptly and comprehensively, ensuring alignment with the company’s strategic goals. The dedication of a full-time CFO can bring real-time financial analytics and risk management solutions that foster sustainable growth and drive long-term success.

Key Differences Between Fractional and Full-Time CFO Services

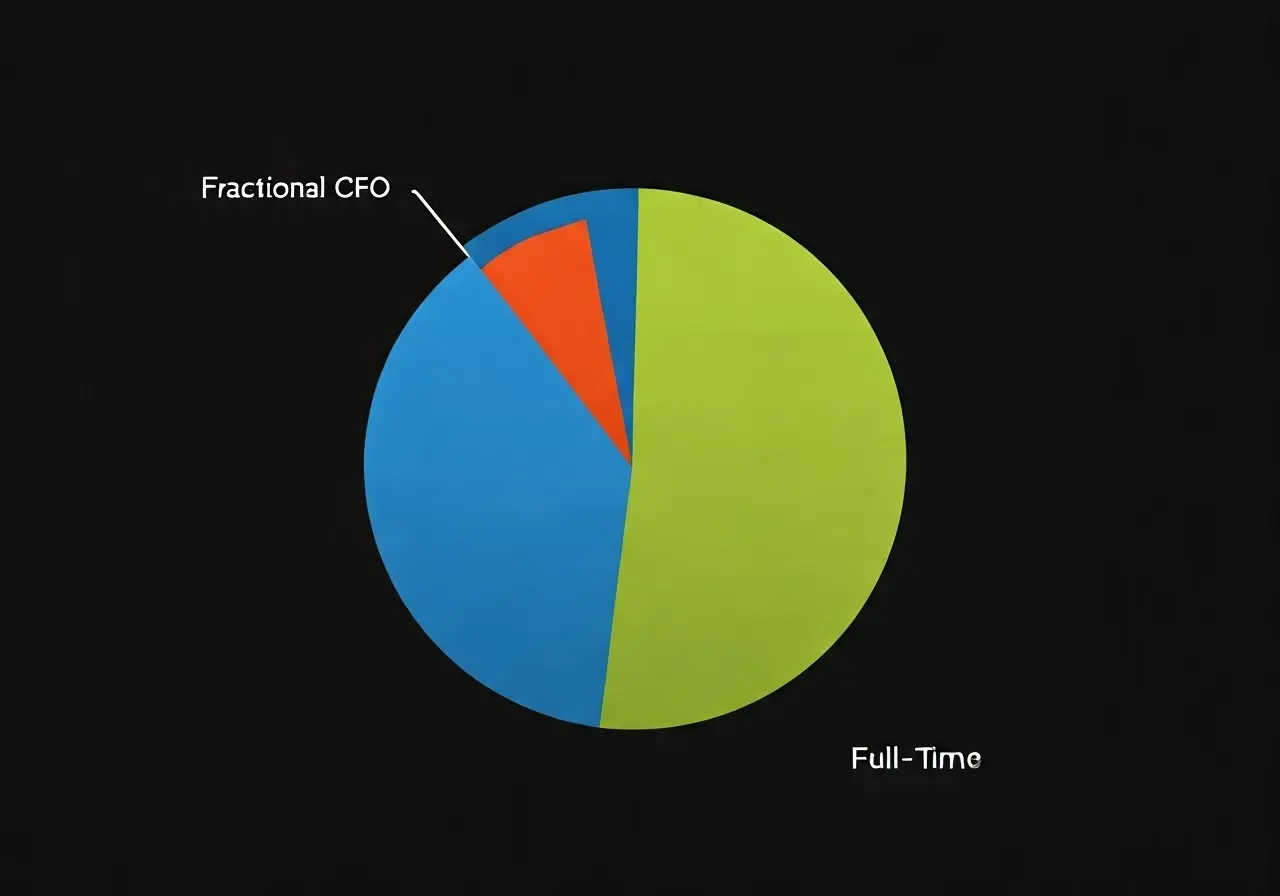

The main differences lie in cost, time commitment, and strategic involvement. Fractional CFOs provide flexibility and lower costs, while full-time CFOs offer consistent presence and deep involvement in the company. A fractional CFO provides the expertise and strategic insight you need on a tailored schedule, allowing smaller businesses to have access to high-level guidance without the financial burden of a full-time executive Why Hire a Fractional CFO vs. a Full-Time CFO?.

On the other hand, a full-time CFO is dedicated solely to one organization, offering stability and continuity in financial management. They play a key role in long-standing strategic initiatives and offer in-depth knowledge of the company’s financial landscape, integrating seamlessly into the leadership team. The choice between fractional and full-time services thus hinges on the specific needs and goals of the business.

Benefits of Fractional CFO Services

Fractional CFOs are cost-effective, provide tailored financial oversight, and allow access to high-level expertise without the cost of a full-time position, making them ideal for startups or smaller companies. With fractional CFO services, businesses can get the strategic support they need to achieve financial health and efficiency without overstretching financial resources.

Aside from cost benefits, fractional CFOs bring a wealth of diverse industry experience that lends fresh perspectives and innovative solutions to financial challenges. They can work on an as-needed basis, providing flexibility that is particularly useful for companies in dynamic markets or those undergoing significant change. This adaptability can be critical for optimizing financial strategies during growth or transition periods, thus maximizing profitability while managing risks effectively.

Benefits of Full-Time CFO Services

Full-time CFOs offer dedicated attention, deep understanding of the business, and the ability to lead long-term financial strategies, which is beneficial for larger companies or those in rapid growth phases. Having a CFO on staff full-time means immediate access to your financial leader for real-time decision-making and strategic alignment that covers all aspects of your financial operations.

This constant availability ensures that business decisions are backed by comprehensive financial insights, enabling integrated strategies for operational and financial excellence. Full-time CFOs can foster deeper relationships with stakeholders, including investors and board members, by consistently demonstrating leadership and a deep understanding of the company’s financial health.

Considerations for Choosing the Right Service

Evaluate your business needs, growth stage, financial complexity, and budget to determine which type of CFO services align best with your organization’s objectives. For example, if your company is experiencing rapid growth or accessing significant investment opportunities, a full-time CFO might provide the ongoing leadership needed.

Conversely, if you’re managing your business with a leaner budget or require intermittent strategic guidance, fractional CFO services might be more advantageous. Carefully consider your long-term goals, industry demands, and how each CFO model aligns with them. Our comprehensive resources can help you make a more informed choice.

Making the Right Choice for Your Business

Choosing between fractional CFO services and full-time CFO services depends on the specific needs and financial capabilities of your business. While fractional CFO services offer flexibility and cost-effectiveness, a full-time CFO provides the advantage of dedicated leadership and long-term strategic planning. Carefully assess your business’s growth stage, financial needs, and budget before making a decision. Gain the expertise you need by exploring our solutions at Gaines Capital Books.